Super Committee to Super Flop?

Even this card-carrying, bleeding-heart, partisan, liberal can agree America has too much debt. The great debate is how we accumulated this debt and how we reduce it.

The accumulated of the debt seems like an Econ 101 class: if you spend more than you bring in, you’ll go in debt. But, it’s not that clear. Much of the spending was on two unfunded and ill-advised, bi-partisan wars. More debt was incurred through an unfunded prescription drug benefit. But, all too much of the debt was piled on because of tax cuts started by George W. Bush and continued by President Obama and, perpetuated by the collective clinging to President Reagan’s failed voodoo economics.

Because Congress in unwilling or unable to do its job, it created a “Super Committee” made of 6 from the Democratic Party and 6 from the Republican Party charged with negotiating a $1.2 Trillion deal or forcing automatic and substantial reductions to the Defense budget and social programs.

Many think Republicans in Congress really don’t want to cut defense and Democrats really don’t want to cut social programs, therefore they will really come to an agreement. But, as many GOP members have signed an oath to Grover Norquist to not raise taxes, Vegas bookmakers think the only question regarding the final results of negotiations is, my question is, Will the Democrats on the committee give away the farm or give away the moon?

The richest 400 families in America own more of the wealth of America than the bottom 150 million Americans combined. Will the Super Committee ask them pay any more in taxes? Will they be asked to pay the same rate they did during the Clinton years when they did very, very well economically? Or, is it more likely our elderly will be asked to pay more for their Medicare or take a cut in Social Security? Will the Democratic members give in to the continued call from Republicans and Blue Dog Democrats to cut benefits to our most impoverished Americans and chronically unemployed or unemployable?

Sadly, I predict capitulation and unilateral disarmament by the Democratic members of the Super Committee is forthcoming. I’ll be the first to gleefully point out my mistake if I’m wrong. It is logical to find revenue in tax increases and the removal of tax loopholes for the wealthiest among us to mitigate the expected cuts in government services to the poorest Americans and the already overburdened middle-class. But, my optimism is over-taxed.

Labels: Democrats, George W. Bush, GOP, Politics, President Obama, Taxes

Corporate America

Labels: Corporate America, Taxes

Tax Cuts

Labels: Bush, Humor, Obama, Taxes

Zombies Have Already Killed The Deficit Commission

Paul Krugman

Paul KrugmanIt must have sounded like a good idea (although not to me): establish a bipartisan commission of Serious People to develop plans to bring the federal budget under control.

But the commission is already dead — and zombies did it.

OK, the immediate problem is the statements of Alan Simpson, the commission’s co-chairman. And what got reporters’ attention was the combination of incredible insensitivity – the “lesser people”??? — and flat errors of fact.

But it’s actually much worse than that. On Social Security, Simpson is repeating a zombie lie — that is, one of those misstatements that keeps being debunked, but keeps coming back.

Specifically, Simpson has resurrected the old nonsense about how Social Security will be bankrupt as soon as payroll tax revenues fall short of benefit payments, never mind the quarter century of surpluses that came first.

We went through all this at length back in 2005, but let me do this yet again.

Social Security is a government program funded by a dedicated tax. There are two ways to look at this. First, you can simply view the program as part of the general federal budget, with the the dedicated tax bit just a formality. And there’s a lot to be said for that point of view; if you take it, benefits are a federal cost, payroll taxes a source of revenue, and they don’t really have anything to do with each other.

Alternatively, you can look at Social Security on its own. And as a practical matter, this has considerable significance too; as long as Social Security still has funds in its trust fund, it doesn’t need new legislation to keep paying promised benefits.

OK, so two views, both of some use. But here’s what you can’t do: you can’t have it both ways. You can’t say that for the last 25 years, when Social Security ran surpluses, well, that didn’t mean anything, because it’s just part of the federal government — but when payroll taxes fall short of benefits, even though there’s lots of money in the trust fund, Social Security is broke.

And bear in mind what happens when payroll receipts fall short of benefits: NOTHING. No new action is required; the checks just keep going out.

So what does it mean that the co-chair of the commission is resurrecting this zombie lie? It means that at even the most basic level of discussion, either (a) he isn’t willing to deal in good faith or (b) the zombies have eaten his brain. And in either case, there’s no point going on with this farce.

linkLabels: economy, GOP, Krugman, Taxes

While Teabaggers Whine, Taxes Fall

Amid complaints about high taxes and calls for a

Amid complaints about high taxes and calls for a

smaller government, Americans paid their lowest

level of taxes last year since Harry Truman's

presidency, a USA TODAY analysis of federal data

found.

Some conservative political movements such as the

"Tea Party" have criticized federal spending as being

out of control. While spending is up, taxes have

fallen to exceptionally low levels.

Federal, state and local taxes — including income,

property, sales and other taxes — consumed 9.2% of

all personal income in 2009, the lowest rate since

1950, the Bureau of Economic Analysis reports. That

rate is far below the historic average of 12% for the

last half-century. The overall tax burden hit bottom

in December at 8.8.% of income before rising

slightly in the first three months of 2010.

"The idea that taxes are high right now is pretty

much nuts,"... MoreLabels: Conservative, Politics, President Obama, Taxes, Teabagging

We Don't Need No Steenkin' Guv'mint!

Labels: GOP, Gun Rights, Humor, Taxes

"Government is too big!" - Rick Perry's Hypocrisy

Galveston, Texas is going through an enormous disaster this weekend.

Flooding at critical levels brought on by thunderstorms is causing great distress in the region.

Just two days after whined

the federal government oppression:

Perry told reporters following his speech that Texans might get so frustrated with the government they would want to secede from the union.

“There’s absolutely no reason to dissolve it. But if Washington continues to thumb their nose at the American people, you know, who knows what might come out of that.” ...the Governor calls

federal aid due to a disaster.

Labels: hypocrites, Republicans, Taxes, Texas

A $91 Billion gift to their friends

Washington State Senators Murray and Cantwell were among the 10 Democrats joining all 41 Republicans to

cut estate taxes for America's wealthiest families.

We'll have to wait and see what comes out of the compromise bill. The give-away to the rich is not in the House bill nor in the Obama budget.

Labels: Barack Obama, Democrats, Maria Cantwell, Patty Murray, Taxes

The media's tax fraud

An article worth reading from

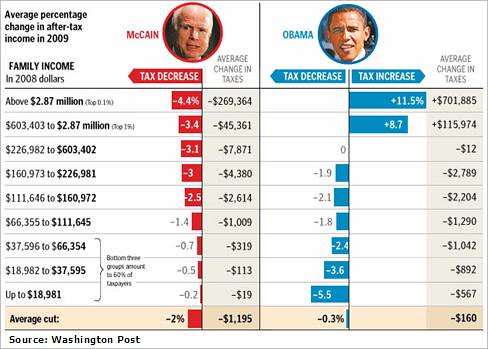

Media Matters on the fraud corporate media plays with President Obama's tax policy.

The money quote:

See, when the Republican Congress passed, and President Bush signed, the tax cuts in 2001, they decided not to make them permanent, scheduling them to expire in 2010. Obama's proposal simply allows that to happen for the top rates -- it makes no change to what is already going to happen under current law.Labels: Barack Obama, Democrats, media, Republicans, Taxes